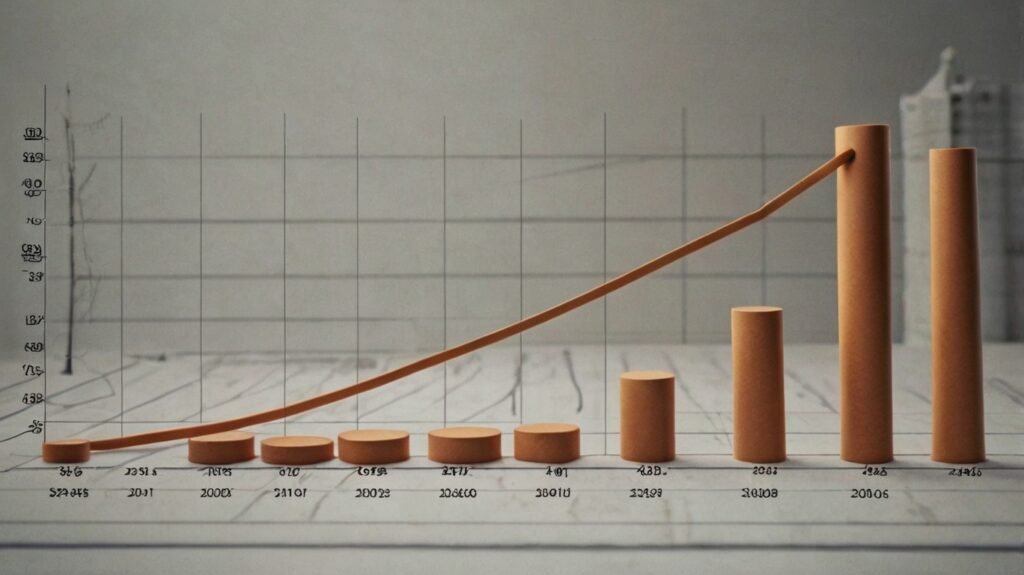

Imagine putting your money into an investment or savings account and watching it grow not only from the initial deposit but also from interest accrued on that interest. This fascinating phenomenon is known as compound interest. Unlike simple interest, which earns interest only on the principal amount, compound interest also earns interest on the accumulated interest. This can transform a modest investment into a substantial sum over time.

What Makes Compound Interest So Crucial?

Compound interest is a key concept for anyone looking to grow their wealth. It leverages exponential growth, making it a powerful tool for both investing and saving. With compound interest, your money grows not just over time but accelerates in growth, potentially leading to significant financial gains. Understanding this concept is crucial for maximizing your financial future.

Compound Interest Definition

Compound interest refers to earning interest on both the principal amount and the interest that has already been added. Essentially, you earn interest on your initial investment plus any interest that has been added to it over time. This results in exponential growth of your investment.

How Simple Interest and Compound Interest Are Different

To appreciate the power of compound interest, it’s helpful to compare it with simple interest. Simple interest is calculated only on the original principal amount. For instance, if you invest $1,000 at a 5% annual interest rate, you would earn $50 in simple interest each year.

In contrast, compound interest is calculated on the principal plus any accrued interest. With a $1,000 investment at a 5% annual interest rate, you would earn $50 in interest the first year. However, in the second year, you earn interest on $1,050 (the original principal plus the first year’s interest), resulting in more interest earned. This process continues, leading to accelerated growth.

The Workings of Compound Interest

To calculate compound interest, use the formula:

A=P(1+rn)ntA = P \left(1 + \frac{r}{n}\right)^{nt}A=P(1+nr)nt

Where:

- AAA is the total amount of money after nnn years, including interest.

- PPP is the principal amount (initial sum of money).

- rrr is the annual interest rate (decimal).

- nnn is the number of times interest is compounded annually.

- ttt is the number of years the money is invested or borrowed.

Being Aware of Compounding Frequency

Compounding frequency can significantly affect your returns. Here’s a quick overview:

- Daily: Interest is calculated and added to your account every day.

- Monthly: Interest is computed and added each month.

- Annually: Interest is added once a year.

More frequent compounding means your money grows faster since you earn interest on interest more often.

Compounding Over Time: Its Magic

The Rule of 72

The Rule of 72 offers a simple way to estimate how long it will take for an investment to double in value, given a fixed annual rate of return. Divide 72 by the annual interest rate. For example, with an 8% return, your investment will double in approximately 9 years (72 divided by 8).

Actions with Compound Interest Examples

Quick-Paying Ventures

Even short-term investments benefit from compound interest. For example, high-yield savings accounts or short-term bonds can provide substantial returns, especially if interest is compounded daily or monthly.

Prolonged Investments

Compound interest truly shines with long-term investments. Retirement accounts like 401(k)s or IRAs can grow significantly over several decades due to compounding. The longer you leave your money invested, the more pronounced the compounding effect.

Optimizing Compound Interest’s Advantages

Starting your investments early gives compound interest more time to work its magic. Early investment allows you to take full advantage of compounding over an extended period, leading to potentially significant growth.

Frequent Contributions and Uniformity

Consistently contributing to your investments can enhance the benefits of compound interest. Regular additions not only increase your principal faster but also enable you to earn interest on these additional amounts.

Selecting the Appropriate Investment Product

Different investment vehicles offer various compounding frequencies and rates. To maximize compound interest, choose investments with favorable terms and higher yields. Consider options such as certificates of deposit (CDs), mutual funds, and index funds.

Typical Errors to Steer Clear Of

Failing to Reinvest Profits

A common mistake is not reinvesting earnings. When you don’t reinvest interest or dividends, you miss the chance to earn interest on these amounts, reducing your overall growth potential.

Not Taking Advantage of Tax-Advantaged Accounts

Tax-advantaged accounts like 401(k)s and Roth IRAs can significantly enhance compound interest benefits. These accounts often offer tax-free growth or tax-deferred contributions, allowing your money to compound more efficiently.

Applications of Compound Interest in Real Life

Compound interest is vital for retirement savings. By starting early and letting your retirement accounts grow over time, you can achieve a comfortable and secure retirement.

Funds for Education

Creating an education fund benefits greatly from compound interest. Investing in a 529 plan or similar account can build a substantial amount for future educational expenses.

Funds for Emergencies

An emergency fund with compound interest helps build your safety net over time. Regular contributions and allowing your emergency fund to grow can provide financial security for unexpected expenses.

Instruments and Materials

Numerous online calculators can help you estimate how compound interest will impact your investments. These tools allow you to input different variables and visualize potential growth.

Apps for Financial Planning

Financial planning apps can assist in managing contributions, tracking investments, and understanding how compound interest benefits you. Apps like Mint, Personal Capital, and others can help with planning and optimizing your financial progress.

In Summary

To sum up, compound interest is a powerful financial tool that can have a significant long-term impact on your wealth. By understanding how it works and leveraging its benefits, you can make your money work harder for you. Start early, remain consistent, and choose the right investment vehicles to fully realize the potential of compound interest. Although the path to financial success is ongoing, compound interest makes the journey far more rewarding.

FAQs

What distinguishes simple interest from compound interest?

Simple interest is calculated only on the initial principal amount, while compound interest is calculated on the principal plus any accrued interest.

Which popular investing strategies take advantage of compound interest?

Common investment options include certificates of deposit (CDs), retirement accounts (401(k)s and IRAs), mutual funds, index funds, and savings accounts.

To optimize compound interest, how frequently should I reinvest my earnings?

Reinvesting earnings as frequently as possible—ideally monthly or even daily—yields the maximum benefits from compound interest.

Is compound interest a disadvantage for me?

Compound interest can work against you if you have debt. For example, credit card debt compounds interest rapidly, potentially leading to significant debt accumulation if not managed properly.