What comes to mind when you think of retirement? For many, it’s a vision of enjoying leisurely days free from the grind of a 9-to-5 job. Turning this vision into reality requires a solid plan. While retirement planning might seem complex, it can be simplified by breaking it down into manageable steps. This guide will provide you with the essentials needed to secure your future and enjoy a worry-free retirement.

Acknowledging Retirement Strategy

Retirement planning involves preparing financially for the time when you will rely on savings and investments rather than employment to support your lifestyle. It’s crucial to have a strategy that ensures you will have enough money to live comfortably once your regular paycheck ceases. Saving money is just one aspect of this preparation.

Why Does It Matter So Much?

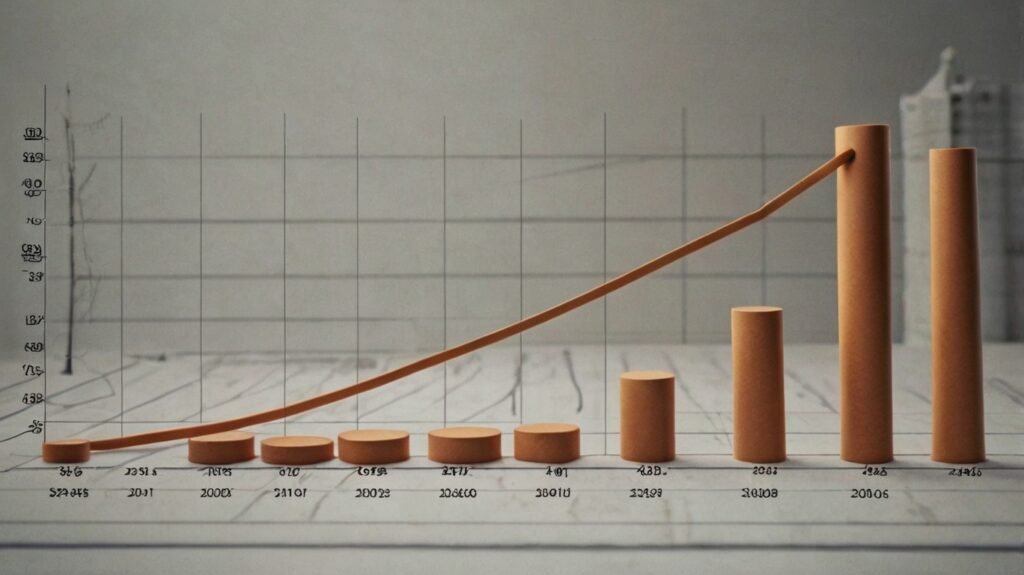

Effective retirement planning alleviates the stress of financial uncertainty in your later years. Starting early allows you to manage risks, benefit from compound interest, and make informed decisions about your financial future.

Selecting Your Retirement Goals

When setting retirement goals, distinguish between short-term and long-term objectives. Short-term goals might include paying off a mortgage or saving for a vacation. Long-term goals focus on your overall retirement strategy, including the lifestyle you want and your planned retirement age.

Choosing Your Ideal Retirement Lifestyle

Consider what type of retirement you envision. Do you want to travel extensively, pursue hobbies, or simply relax at home? The lifestyle you choose will determine how much you need to save and how you should invest your money.

Assessing Your Current Financial Situation

Start by calculating your net worth, which is the difference between your assets (what you own) and liabilities (what you owe). Understanding your net worth provides a clear picture of your current financial situation and helps identify areas that need improvement.

Evaluating Your Current Revenue and Expenses

Track your income and expenses to understand where your money is going. This will help you create a budget and identify potential savings that can be redirected to your retirement fund.

Estimating Retirement Requirements for the Future

Estimate how much money you will need in retirement by projecting future expenses. Consider necessities such as housing, utilities, food, and transportation. Also, account for unexpected costs.

Accounting for Medical Expenses and Inflation

Inflation will gradually reduce your purchasing power, so factor it into your calculations. Additionally, healthcare costs are rising, so include a buffer for medical expenses in your retirement planning.

Creating a Retirement Savings Plan

Types of Retirement Accounts

There are several types of retirement accounts, each with unique benefits:

- 401(k): Offered by employers, this account allows you to save money before taxes, reducing your taxable income. Many employers also provide matching contributions, which is essentially free money.

- Individual Retirement Accounts (IRAs): These can be opened independently and come in traditional and Roth varieties. Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement.

Caps on Contributions and Tax Benefits

Be aware of the contribution limits for each type of account and take advantage of the associated tax benefits. Maximizing your contributions can significantly increase your retirement savings.

Investment Strategies for Retirement

Diversification involves spreading your investments across various asset types, such as stocks, bonds, and real estate. A well-diversified portfolio helps protect your savings from market volatility.

Risk Tolerance and Asset Allocation

Assess your risk tolerance and adjust your asset allocation accordingly. Younger individuals might be able to take more risks with their investments, while those nearing retirement may prefer more stable, income-producing assets.

Establishing an Emergency Fund

An emergency fund provides financial security for unexpected expenses. It is essential for preserving your financial stability and avoiding the need to dip into your retirement savings for emergencies.

What’s the Right Amount to Save?

Aim to save at least three to six months’ worth of expenses in your emergency fund. This amount protects your retirement plan without derailing it in the event of unforeseen circumstances.

Control of Debt

Techniques for Debt Reduction

Effective debt management is crucial for a secure financial future. Focus on paying off high-interest debts first, and consider options like refinancing or consolidation to reduce interest rates.

The Impact of Debt on Retirement Planning

High levels of debt can make it challenging to save for retirement. By addressing debt early, you can free up more resources for your retirement fund and reduce financial stress as you age.

Getting the Most Out of Your Social Security Income

Understanding Social Security

Social Security is a vital source of income for many retirees. Learn how the program works and how your work history affects your benefits.

When Recipients Should Receive Benefits

Choose the optimal time to start receiving Social Security payments. Delaying benefits until after your full retirement age can increase your monthly payments, providing greater financial stability in retirement.

Examining Various Revenue Sources

Consultancy or Temporary Work

Consider part-time work or consulting to supplement your retirement income if feasible and desirable. This can be a rewarding way to continue working while earning additional income.

Ways to Earn a Passive Income

Explore options for passive income, such as dividend-paying assets or rental properties. These sources of income can provide financial stability and reduce reliance on your retirement savings.

Organizing a Will

The Importance of Wills and Trusts

Creating an estate plan ensures that your assets are distributed according to your wishes after your death. Wills and trusts help manage and protect your estate, minimizing potential disputes among heirs.

Durable Power of Attorney and Healthcare Directives

Establish a durable power of attorney to manage financial decisions if you become incapacitated, and create healthcare directives to outline your preferred medical treatments. These legal documents ease the burden on your loved ones and ensure your wishes are honored.

Regularly Reviewing and Adjusting Your Plan

The Benefits of Frequent Assessments

Regularly review your retirement plan to ensure it remains on track. Adjust your strategy as needed based on changes in market conditions, personal circumstances, or financial status.

Acclimating to Changes in Life and the Financial Market

Be prepared to modify your retirement plan in response to major life events, such as marriage, divorce, or the birth of a child, as well as shifts in the financial market that impact your investments.

Common Mistakes in Retirement Planning

Disregarding Inflation

Many people underestimate the impact of inflation on their retirement funds. Ensure that your investment strategy includes assets capable of outpacing inflation.

Underestimating Health Care Expenses

Healthcare costs in retirement can be substantial. Consider options such as health savings accounts (HSAs) and build a cushion within your retirement funds to cover these expenses.

To Sum Up

Retirement planning doesn’t have to be complicated. By developing a comprehensive savings strategy, evaluating your financial status, and setting clear goals, you can ensure a safe and fulfilling retirement. Remember, starting early and making necessary adjustments are key. With proper planning and consistent effort, you can enjoy the retirement lifestyle you desire and confidently embrace your golden years.

FAQs

When is the best time to start saving for retirement?

The ideal time to begin retirement planning is in your twenties or thirties. Starting early allows your money more time to grow.

How much should I put up for retirement?

A common recommendation is to save 15% of your income for retirement. However, the exact amount depends on your planned retirement lifestyle and anticipated expenses.

Is it possible for me to retire early even with a lot of debt?

Retiring early with significant debt can be challenging. It’s generally advisable to prioritize debt repayment before retiring to ensure financial stability.

How will inflation affect the money I have saved for retirement?

Inflation can reduce the purchasing power of your savings over time. Invest in assets that have the potential to outpace inflation to mitigate this effect.

What are the benefits of using a financial advisor to help you prepare for retirement?

A financial advisor can help create a personalized retirement plan, offer tailored advice, and suggest strategies to maximize your investments and savings.